Building Your M&A Due Diligence Foundation That Actually Works

The success of any M&A transaction depends heavily on a strong due diligence process. It's more than just ticking off items on an M&A due diligence checklist. It's about creating a solid base for making informed decisions. This involves organizing teams across different functions, establishing clear responsibilities, and setting realistic timelines.

These seemingly simple steps are often missed, which can lead to expensive errors later on.

Organizing For Success: The Due Diligence Team

Building a successful M&A due diligence foundation starts with assembling the right team. This means bringing together experts from various departments, including finance, legal, operations, and IT. Each member contributes their specialized knowledge to thoroughly review the target company.

For example, the finance team concentrates on financial statements, while the legal team scrutinizes contracts and regulatory compliance. This collaborative approach helps uncover potential risks and opportunities throughout the business.

Accountability and Timelines: Avoiding Costly Delays

Besides expertise, clear accountability is essential. Every team member should have well-defined roles and responsibilities within the M&A due diligence checklist process. This prevents duplicated work and ensures nothing important gets missed.

Setting realistic timelines, allowing for potential obstacles, is also crucial. This requires understanding the scope of due diligence needed and allotting enough time for each stage. A well-defined timeline keeps the process moving and reduces the chance of costly delays.

Learning From Experience: Real-World Insights

Experienced dealmakers know that M&A due diligence is an iterative process. This means continuously adjusting the approach based on new data and changing market dynamics. This flexibility is key to navigating the intricacies of M&A transactions.

For instance, in 2024, global M&A activity surged. North America saw over $2 trillion in deal value across roughly 17,509 transactions. This represents a 16.4% increase in value and a 9.8% increase in volume year-over-year. This rise in deal complexity demands even more thorough due diligence.

Learn more about these trends and their influence on due diligence here. A strong M&A due diligence foundation built on teamwork, accountability, and adaptability distinguishes successful acquisitions from those that fail. This proactive strategy minimizes risks and maximizes the chances of a smooth and profitable transaction.

Financial Due Diligence: Where Deals Live Or Die

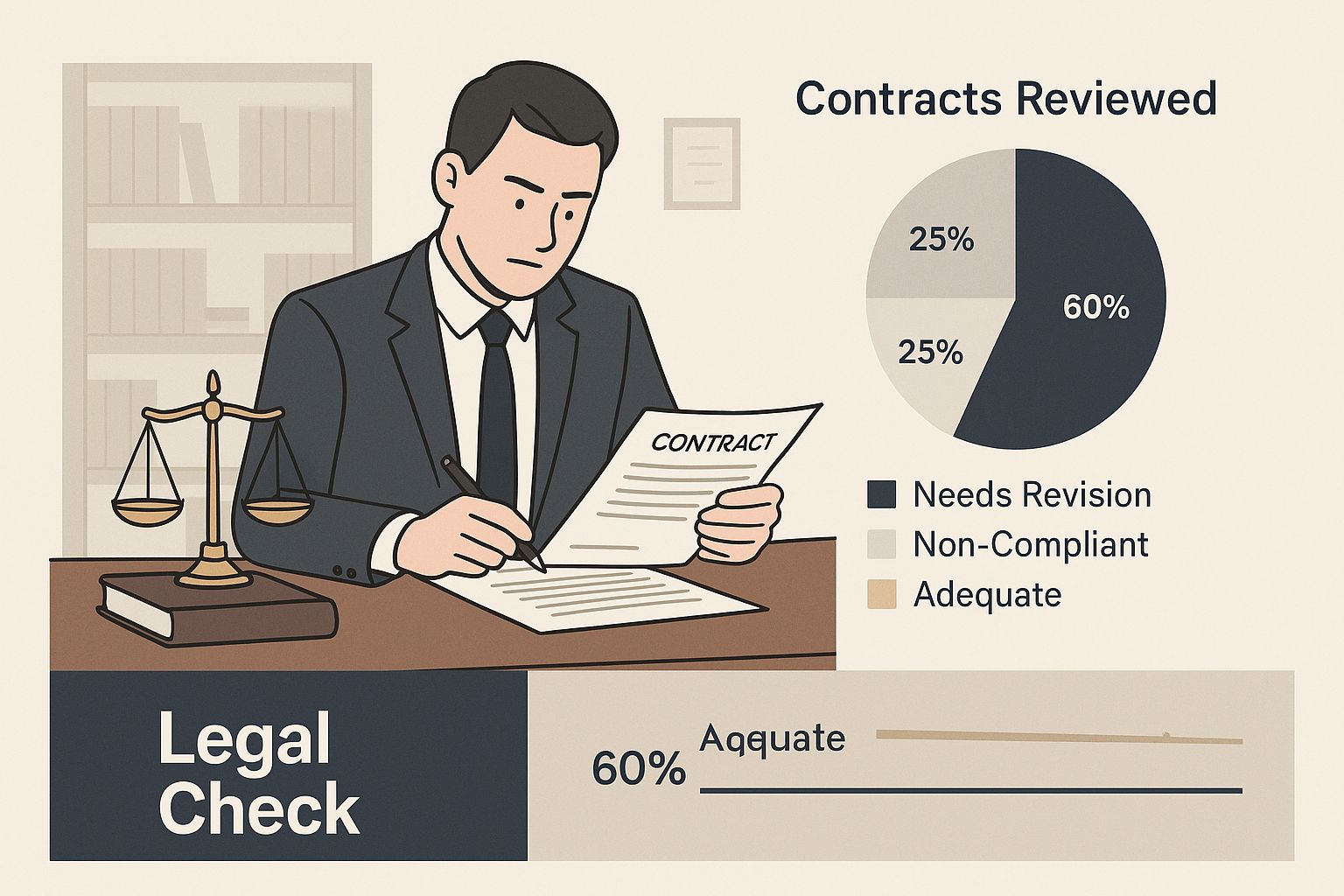

The infographic above shows a lawyer carefully reviewing contracts, emphasizing the vital "Legal Check" stage of due diligence. This visual reminds us of the importance of thorough examination in mergers and acquisitions (M&A). Just as a lawyer analyzes legal documents, financial professionals must rigorously examine financial records. This process is often seen as the key to a successful acquisition. This detailed review helps uncover potential issues and ensures informed decisions, paving the way for a smooth transaction.

Financial due diligence is the foundation of any successful M&A deal. It goes beyond simply glancing at the balance sheet; it's the process of verifying the target company's financial health. This involves a deep dive into the company’s financial records, evaluating everything from the reliability of revenue and cash flow patterns to hidden liabilities and accounting methods.

For example, imagine buying a company boasting impressive growth, only to discover its success depends on one unpredictable client. This highlights why thorough financial due diligence is absolutely critical.

Key Components of Financial Due Diligence

A comprehensive financial due diligence checklist typically includes the following:

Quality of Earnings: This involves assessing how sustainable and reliable the reported earnings are. It includes scrutinizing revenue recognition practices and identifying any unusual or one-time items.

Working Capital Analysis: This evaluates how efficiently working capital is managed and its impact on cash flow. It involves analyzing accounts receivable, inventory turnover, and accounts payable.

Cash Flow Validation: This analyzes historical cash flow statements to find trends and irregularities. It also involves forecasting future cash flows to determine the company's ability to generate cash.

Debt and Liability Assessment: This involves carefully examining the target company's debt structure, including loan agreements and other liabilities. Understanding the financial risks associated with the acquisition is crucial.

Accounting Policy Review: This examines the target company's accounting policies to ensure they align with industry standards and regulatory requirements. Differences in accounting practices can significantly affect the company's valuation.

To illustrate the importance of a robust financial review, consider the following table:

A detailed analysis of financial records is a cornerstone of any M&A due diligence checklist. Due diligence teams usually examine the target company’s financial statements (income statements, balance sheets, and cash flow statements) from the past 3 to 5 years. This review aims to understand trends in revenue, profitability, and liquidity. It helps identify financial risks and confirms whether the acquisition price matches the company's true economic value.

Financial Due Diligence Checklist Components

| Financial Area | Key Analysis Points | Common Red Flags | Impact Level |

|---|---|---|---|

| Quality of Earnings | Revenue recognition policies, recurring vs. non-recurring revenue | Inconsistent revenue streams, aggressive revenue recognition | High |

| Working Capital Analysis | Days sales outstanding, inventory turnover, days payable outstanding | Slow inventory turnover, high days sales outstanding | Medium |

| Cash Flow Validation | Operating cash flow, free cash flow, capital expenditures | Discrepancies between reported earnings and cash flow | High |

| Debt and Liability Assessment | Debt-to-equity ratio, loan covenants, off-balance sheet liabilities | Hidden liabilities, high debt levels | High |

| Accounting Policy Review | Compliance with GAAP, consistency of accounting policies | Changes in accounting policies, deviations from industry norms | Medium |

This table provides a snapshot of the key areas within financial due diligence, emphasizing the relationship between analysis points, potential red flags, and the overall impact on the deal. By carefully examining these areas, potential issues can be identified early in the process.

Studies suggest that performing this level of financial due diligence effectively can decrease deal failure rates by up to 30%, highlighting its significant role in successful M&A transactions worldwide. For more detailed statistics, see this article.

Advanced Techniques and Frameworks

Experienced dealmakers use advanced techniques to gain a more in-depth understanding, such as:

Trend Analysis: This examines past financial data to identify trends in key performance indicators (KPIs) and make informed predictions about future performance.

Sensitivity Analysis: This evaluates how various assumptions and scenarios affect the target company's financial projections, helping assess potential downside risks.

Benchmarking: This compares the target company's financial performance with industry averages and competitors to identify strengths and weaknesses.

You may also find this resource helpful: How to master contract review. By implementing a systematic approach to financial due diligence, buyers can uncover hidden problems, negotiate favorable terms, and ultimately improve the chances of a successful acquisition. This careful analysis provides a thorough understanding of the target company's financial health and future potential.

Legal And Regulatory Review That Protects Your Investment

Thorough legal due diligence is paramount to a successful Merger & Acquisition (M&A). Overlooking legal intricacies can lead to significant post-acquisition problems, potentially jeopardizing the entire deal. This involves a comprehensive review of all relevant legal documents and an assessment of potential liabilities. This process helps protect your investment and ensures a smooth transition.

Identifying Potential Liabilities: A Critical Step

A key aspect of legal due diligence is identifying potential liabilities. This means examining everything from ongoing litigation and potential regulatory violations to contractual obligations and environmental compliance. Uncovering these potential issues early is essential for accurately assessing the risks involved.

For example, imagine acquiring a company only to discover it faces a pending lawsuit that could significantly impact its future profitability. This scenario highlights the importance of meticulous legal due diligence.

Regulatory Compliance and Intellectual Property: Protecting Your Assets

Beyond liabilities, assessing regulatory compliance risks is crucial. This includes examining the target company's adherence to industry regulations and any potential violations. Additionally, evaluating the intellectual property portfolio is essential, especially in industries where intellectual property is a key asset.

This careful examination helps determine the true value of the company's intellectual property and identifies potential infringements that could impact its future. Understanding these aspects ensures that the acquisition aligns with your long-term goals.

Managing Cross-Border Transactions and Environmental Compliance: Navigating Complexity

For cross-border transactions, legal due diligence becomes even more complex. Different legal systems and regulations require specialized expertise. This also applies to environmental compliance, where potential environmental liabilities can have a significant financial impact.

Failing to address these issues early can lead to costly remediation efforts and legal battles. Bringing in experts who can identify potential problems and guide you through international legal complexities is essential. Learn more in our article about How to master business legal advice.

Structuring Your Legal Review: A Proactive Approach

A well-structured legal review process is crucial for uncovering critical issues early on. This allows you to negotiate appropriate protections and avoid potential pitfalls. A proactive approach helps address concerns before they escalate.

For example, a structured legal review process might involve using a Legal Due Diligence Priority Matrix. This matrix helps prioritize areas of focus based on the specific deal, industry, and regulatory complexity.

To help illustrate a potential structure, we've provided a sample matrix below:

Legal Due Diligence Priority Matrix

The following table provides a prioritization framework for legal review areas based on deal size, industry, and regulatory complexity.

| Legal Category | Priority Level | Review Timeline | Key Documents | Specialist Required |

|---|---|---|---|---|

| Contracts | High | Week 1-2 | Customer contracts, vendor agreements | Contract Law Specialist |

| Litigation | Medium | Week 2-3 | Legal filings, court documents | Litigation Attorney |

| Intellectual Property | High | Week 1-3 | Patents, trademarks, copyrights | IP Attorney |

| Regulatory Compliance | Medium | Week 3-4 | Permits, licenses, regulatory filings | Regulatory Compliance Expert |

| Environmental Compliance | Low | Week 4 | Environmental audits, permits | Environmental Lawyer |

This matrix helps allocate resources efficiently and ensures that critical areas are covered within the necessary timeframe. By addressing these issues early, you're better positioned to negotiate effectively and mitigate potential risks. Ultimately, robust legal and regulatory review is an investment that safeguards your interests and contributes to the success of the M&A transaction.

Operational Assessment: Finding The Real Value Drivers

Operational due diligence often reveals the true story behind a company's financial performance. Numbers offer a glimpse, but a deep dive into operations unveils the mechanisms driving those numbers and exposes the potential for future value creation. This operational assessment, a vital element of any robust m&a due diligence checklist, separates successful acquisitions from costly errors.

Assessing Management Quality and Operational Efficiency

Seasoned dealmakers know that strong management and efficient operations are essential for long-term success. Evaluating management quality involves assessing the leadership team's experience, expertise, and capacity to execute the company's strategy. This goes beyond mere titles, focusing on their track record and decision-making prowess.

Operational efficiency, conversely, centers on how effectively the company utilizes its resources to generate revenue and manage costs. This involves scrutinizing key performance indicators (KPIs) like inventory turnover, production cycle times, and customer service metrics. Like a well-oiled machine, efficient operations signify a healthy business.

Analyzing Customer Relationships and Supplier Dependencies

Another critical area is evaluating the target company's customer relationships. Understanding customer concentration, retention rates, and the overall strength of these relationships provides valuable insights into revenue stability and future growth potential. A company heavily reliant on a few key customers may be susceptible to revenue fluctuations if those relationships weaken.

Equally vital is assessing supplier dependencies. A diversified supplier base mitigates the risk of disruptions and provides negotiating leverage. Much like a chef needs dependable ingredient suppliers, a business relies on its supply chain for seamless operations.

Identifying Operational Synergies and Scalability Potential

Savvy acquirers look for operational synergies that can generate value beyond the sum of the individual companies. These synergies might include cost savings through economies of scale, increased revenue through cross-selling opportunities, or enhanced operational efficiencies through shared resources. These are often the driving forces behind the acquisition and demand thorough analysis.

Finally, assessing the scalability potential of the target company is crucial, particularly for growth-focused acquisitions. This involves evaluating the company's ability to expand its operations and manage increased demand without substantial investments in infrastructure or personnel. A scalable business model is essential for capturing market share and achieving sustainable growth.

Uncovering Operational Strengths and Weaknesses

Beyond these core areas, operational due diligence explores other crucial factors. Understanding the target company's technology infrastructure, evaluating its human capital, and assessing its competitive positioning are all vital components of a comprehensive operational assessment.

This holistic approach helps reveal both operational strengths that can be leveraged post-acquisition and operational weaknesses that require attention. By identifying potential risks and opportunities early, acquirers can make more informed decisions and develop effective integration strategies. This thorough examination ultimately dictates the success of the integration and directly impacts post-acquisition performance. This proactive approach increases the likelihood of a smooth transition and maximizes the acquisition's value.

Technology And Data Management For Modern Deal Teams

Effective Mergers and Acquisitions (M&A) due diligence isn't simply about being thorough; it's about efficiency. Leading deal teams use technology to transform the traditionally labor-intensive due diligence process into a strategic advantage. This allows for more in-depth analysis under tight deadlines, resulting in better-informed decisions.

Virtual Data Rooms: Streamlining Document Review

One of the most significant technological advancements impacting M&A due diligence checklists is the rise of Virtual Data Rooms (VDRs). VDRs are secure online repositories that centralize all critical documents, providing efficient access and collaboration for everyone involved. Think of a VDR as a highly organized, secure digital library containing everything from financial statements and contracts to intellectual property records and employee agreements.

This centralized approach streamlines document review, enabling deal teams to quickly find and analyze necessary information. Furthermore, VDRs enhance security, ensuring sensitive data is protected throughout the transaction process.

By 2025, VDRs had become essential for due diligence. They streamline access to crucial documents such as contracts, financials, tax returns, employee agreements, and intellectual property records. Studies show that deals using VDRs experience a 25-35% reduction in due diligence cycle times, enabling more thorough analysis within tighter deal timelines. Learn more here.

Advanced Analytics: Uncovering Hidden Patterns

Beyond document management, advanced analytics tools are changing how deal teams analyze data. These tools use algorithms to identify trends, anomalies, and potential risks that traditional methods might miss. For example, an analytics tool could flag unusual increases in customer churn or inconsistencies in revenue recognition – insights that are crucial in evaluating a target company's financial health.

This data-driven approach allows dealmakers to make more informed decisions based on objective data, minimizing the risk of unexpected issues after the acquisition.

AI-Powered Analysis and Automation: Accelerating Timelines

Integrating artificial intelligence (AI) further improves the due diligence process. AI-powered tools can automate tasks like document review and data extraction, allowing deal teams to focus on higher-level analysis and strategic decisions. Think of AI as a dedicated assistant sifting through large amounts of data, pinpointing essential information, and summarizing complex documents quickly.

Additionally, AI can identify patterns and relationships that a human analyst might not readily see, offering valuable insights to inform deal strategy.

Collaborative Platforms and Data Security

Effective due diligence requires seamless collaboration among all stakeholders, including internal teams, external advisors, and the target company. Secure collaborative platforms simplify communication, document sharing, and real-time updates, keeping everyone informed.

This streamlined communication fosters transparency and efficiency, enabling deal teams to act quickly and decisively. However, increased data sharing requires robust security measures. Maintaining data integrity and complying with regulations is crucial. Implementing strong security protocols and using encrypted communication channels are essential to protect sensitive information. This combined approach, integrating technology with robust security, empowers deal teams to conduct thorough analyses under tight deadlines while maintaining the rigor needed to protect investments and support confident decision-making.

Risk Mitigation Strategies That Actually Work

Finding problems during due diligence is expected. Effectively addressing them is key to successful deals. This section explores practical strategies for mitigating risks uncovered during due diligence and structuring deals that protect your interests while preserving potential upside. Essentially, we'll discuss transforming due diligence findings into actionable safeguards.

Negotiation Strategies Based on Due Diligence Discoveries

Due diligence findings are powerful negotiation tools. For example, uncovering undisclosed liabilities can be used to renegotiate the purchase price or include specific indemnification clauses. This proactive approach helps avoid inheriting unforeseen problems.

Price Adjustments: Adjusting the purchase price to reflect the financial impact of discovered risks is a common strategy. This might involve a straightforward reduction in the offer price or structuring the deal with a contingent payment tied to future performance, creating a balance between risk and reward.

Earnout Structures: An earnout, where part of the purchase price is paid later, contingent on the target company achieving specific milestones, is another useful tool. This incentivizes the seller to ensure a smooth transition and continued success after the acquisition. It also protects the buyer if performance doesn't meet initial expectations.

Indemnification Provisions: Indemnification clauses protect the buyer from financial losses stemming from pre-existing issues or misrepresentations by the seller. They define the seller’s liability and the process for compensation. A well-crafted clause provides legal recourse if unexpected problems arise.

You might be interested in: How to master contract negotiations.

Contingency Plans for Major Risk Factors

Beyond deal structuring, developing contingency plans for major risk factors is crucial. This involves identifying potential post-acquisition problems – such as customer loss, key employee departures, or regulatory changes – and outlining specific mitigation actions. For instance, a plan might include strategies for retaining key customers, recruiting replacements, or adapting to new regulations. This preparedness minimizes disruption and protects your investment.

Insurance Coverage and Ongoing Risk Management

Insurance coverage plays a vital role in risk mitigation. Acquiring appropriate policies can transfer some identified risks to a third party. This could include representations and warranties insurance, protecting against losses from breaches of representations and warranties made by the seller. Other relevant types include product liability, environmental liability, and key person insurance.

Establishing monitoring mechanisms for ongoing risk management is also crucial. This might involve implementing regular performance reviews, financial audits, and compliance checks. These ongoing checks provide early warning signs of potential problems, enabling proactive intervention. Continuous monitoring ensures risks are managed effectively throughout integration and beyond.

Managing Integration Risks and Preserving Relationships

Successfully integrating the acquired company is often as important as the due diligence process itself. Integration risks can include cultural clashes, systems incompatibility, and loss of key personnel. Mitigating these risks requires careful planning and execution. Fostering open communication can help bridge cultural differences. A phased integration approach can minimize operational disruption. Proactively addressing employee concerns and providing support can help retain valuable talent.

Preserving key customer and supplier relationships during the transition is also paramount. Maintaining consistent communication and promptly addressing concerns helps build trust and ensures business continuity. These relationships are often vital to the target company’s success and should be nurtured throughout the integration process. By combining these risk mitigation strategies with a solid M&A due diligence checklist, you're well-equipped to protect your investment, maximize deal value, and ensure a smooth transition. This proactive approach not only safeguards against potential problems but creates a solid foundation for post-acquisition success.

Your Complete Due Diligence Success Framework

This framework provides a practical roadmap for M&A due diligence, designed to ensure your process creates real value. We'll explore actionable checklists, implementation timelines, and success metrics to guide you through a successful M&A process.

Critical Success Factors: The Pillars of Effective Due Diligence

Several key elements underpin successful M&A due diligence. These are the foundations upon which you build success:

Clearly Defined Objectives: Begin with a crystal-clear understanding of your acquisition goals. This clarity focuses your due diligence efforts on the most relevant information.

Comprehensive M&A Due Diligence Checklist: A detailed checklist, specific to the industry and transaction type, ensures thoroughness. This structured approach streamlines information gathering and analysis.

Experienced Due Diligence Team: A skilled team with expertise in finance, legal, operations, and other relevant areas is essential. Diverse perspectives provide a holistic view of the target company.

Effective Communication: Open communication between the buyer, seller, and advisors is paramount. Transparency builds trust and facilitates proactive problem-solving.

Implementation Challenges and Solutions: Overcoming Common Obstacles

Even seasoned dealmakers face challenges during due diligence. Anticipating and addressing these hurdles is key to success:

Tight Timelines: M&A transactions often have strict deadlines. Develop a realistic timeline and prioritize critical due diligence areas.

Information Asymmetry: Sellers typically possess more information than buyers. Thorough due diligence helps bridge this gap, enabling informed decisions.

Integration Complexities: Integrating the acquired company can be challenging. Early integration planning during due diligence ensures a smoother post-acquisition transition.

Maintaining Quality Under Pressure: Pressure to close deals quickly can compromise due diligence quality. Maintaining a rigorous approach throughout the process is crucial.

Proven Strategies: Establishing Protocols, Managing Expectations, and Documenting Effectively

A structured approach enhances due diligence efficiency and accuracy. These strategies can guide your efforts:

Communication Protocols: Establish clear communication protocols for all involved parties. This ensures timely and effective information flow.

Stakeholder Management: Manage expectations by keeping stakeholders informed of progress and any emerging issues. Transparency fosters collaboration.

Documentation Standards: Implement clear documentation standards for recording due diligence findings. This supports informed decision-making and provides valuable records for post-acquisition integration.

Ready-to-Use Templates and Measurement Frameworks: Implementing for Immediate Impact

Templates and frameworks streamline due diligence. A robust framework might include:

Due Diligence Checklist Template: A customizable template ensures comprehensive coverage based on the specific transaction.

Implementation Timeline Template: A template helps estimate the time required for each stage.

Success Metrics: Define metrics to track the effectiveness of your due diligence, such as issues identified, cost savings, and timeline adherence.

By implementing these practices and consistently monitoring performance, you can make informed decisions, mitigate risks, and maximize the value of your M&A transactions. This approach sets the stage for post-acquisition success and sustainable growth.

Looking for expert legal guidance? Cordero Law, a boutique law firm in New York City, specializes in business law and M&A. Contact Cordero Law today to discuss your needs and ensure your deal is structured for success.