Decoding Attorney Fees for Your Small Business

Understanding attorney fees is crucial for managing your small business budget. This list breaks down six common attorney fee structures for small businesses, including hourly rates, flat fees, retainers, contingency fees, subscriptions, and court costs. Whether you're a musician, entrepreneur, or innovator, learning how these fees work helps you choose the best legal representation and avoid unexpected costs. This guide provides the clarity you need to make informed decisions about your legal spending.

1. Hourly Rates

Hourly rates are the most common fee structure for attorney fees for small business. This means you pay your lawyer for their time, based on a predetermined hourly rate. These rates can vary significantly based on several factors, including the attorney's experience, geographic location, area of expertise, and the complexity of your legal issue. For small business attorneys, hourly rates typically range from $150 to $500 per hour, with more experienced attorneys, such as senior partners, often charging rates at the higher end of this spectrum.

This fee arrangement operates on a time-based billing system, usually broken down into 6-15 minute increments. You’ll receive detailed time tracking and billing statements outlining the work performed, the time spent, and the corresponding charges. This granular approach to billing ensures transparency, allowing you to see exactly what you’re paying for. The specificity of hourly billing is particularly beneficial for tax purposes, providing detailed records for deductions. Rates can vary not only by seniority but also by specialization. For example, an intellectual property lawyer might charge a higher hourly rate than a general business lawyer. This is due to the specialized knowledge and experience required in their respective fields.

Hourly rates offer several advantages. The most significant is that you only pay for the actual time spent on your specific legal matter. This direct correlation between work and cost offers a clear understanding of where your money is going. This structure is also very flexible for projects with an uncertain scope, as you’re not locked into a fixed fee before the full extent of the work is known. This is especially useful for small business owners navigating uncharted territory, like rappers negotiating their first record deal, or music producers securing their copyrights.

However, hourly billing also has some drawbacks. For complex legal matters, costs can escalate quickly. This can make budgeting challenging, particularly for startups or small businesses with limited resources. There's also a potential, though not always realized, concern that hourly billing might incentivize inefficiency, though reputable attorneys are bound by ethical obligations to provide efficient and effective representation. Even small tasks can become unexpectedly expensive if they require more time than initially anticipated. For example, a quick contract review might uncover unexpected clauses, leading to additional research and revisions, and ultimately a higher bill.

Let’s look at some real-world examples: a contract review might require 2-5 hours at $300/hour, totaling $600-$1,500. Business formation services could range from 8-15 hours at $250/hour, costing between $2,000-$3,750. A consultation regarding an employment dispute might take 1-2 hours at $400/hour, for a total of $400-$800. These examples demonstrate the variability of legal costs even for seemingly straightforward tasks.

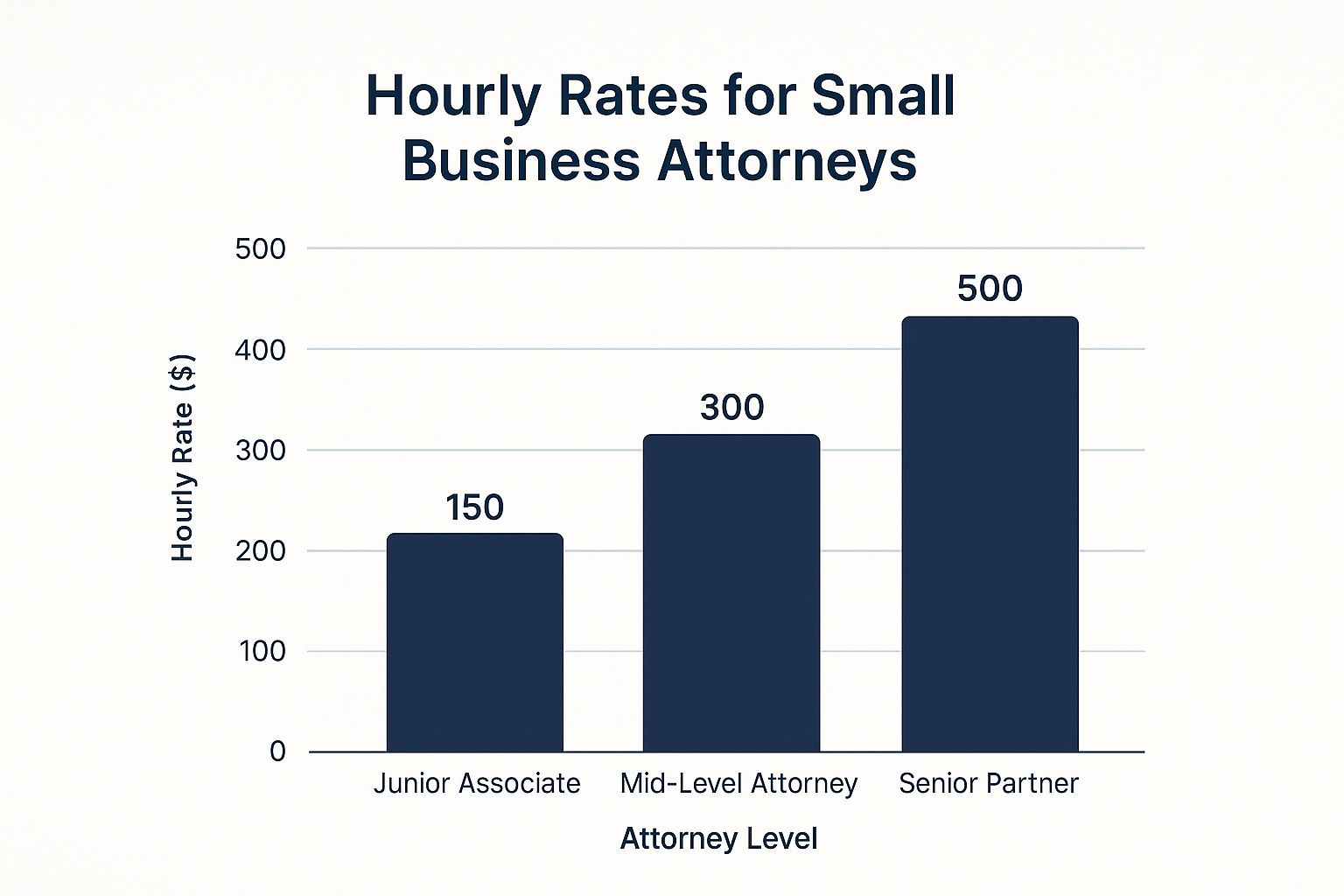

The following infographic visually represents the typical hourly rate breakdown by seniority level:

As shown in the bar chart, the hourly rates increase significantly with experience, highlighting the premium placed on a seasoned attorney’s expertise. Junior associates typically bill around $150/hour, while mid-level attorneys charge around $300/hour. Senior partners, with their extensive experience and specialized knowledge, command the highest rates, often around $500/hour.

To manage legal expenses effectively when working with an attorney on an hourly basis, consider these tips: Always request detailed time entries to understand precisely what you’re being charged for. Set budget caps upfront and require pre-approval for any work exceeding initial estimates. Regularly request updates on the time spent on your matter to stay informed and avoid surprises. Finally, consider negotiating blended rates for teams involving multiple attorneys with varying seniority levels. This can help balance the expertise of senior attorneys with the cost-effectiveness of junior team members.

Learn more about Hourly Rates for a more in-depth look at this common fee structure. Understanding how hourly rates work is crucial for anyone seeking legal counsel, especially for entrepreneurs, business owners, entertainers, artists, and innovators, including rappers, music producers, music artists, managers, and singers navigating the complexities of their respective industries.

2. Flat Fee Arrangements

Navigating the world of attorney fees can be daunting, especially for small businesses. One increasingly popular pricing model that offers greater cost predictability is the flat fee arrangement. This structure provides a fixed price for specific legal services, allowing you to know exactly what you'll pay upfront, regardless of the time your attorney spends on the matter. This eliminates the uncertainty of hourly billing and empowers you to budget effectively for your legal needs. Flat fee arrangements are becoming a go-to solution for routine business legal matters, providing both transparency and peace of mind. This approach is particularly advantageous for entrepreneurs, established business owners, artists, musicians, producers, innovators, and anyone with unique ideas who needs to secure legal assistance without the fear of spiraling costs.

So, how does a flat fee arrangement work? Essentially, you and your attorney agree on a fixed price for a clearly defined scope of work. This scope outlines the specific services included in the fee. For example, if you're forming an LLC, the scope might include drafting and filing the articles of organization, obtaining an EIN, and creating an operating agreement. The payment is typically required upfront or in installments. The clarity of a flat fee arrangement ensures both you and your attorney are on the same page, minimizing the potential for disputes later on. This is why clearly defining the scope of work from the outset is crucial.

Flat fee arrangements are commonly used for predictable, routine legal services such as LLC formation, contract drafting, trademark applications, and basic business sale agreements. For instance, forming an LLC might cost between $1,500 and $3,000, drafting a simple employment contract could range from $800 to $1,500, a trademark application might be between $1,200 and $2,500, and a basic business sale agreement could fall within the $3,000 to $7,500 range. These are just examples, and prices may vary depending on the complexity of the matter and the attorney's location.

This fee structure offers several compelling advantages for small businesses. The predictability of the costs allows for accurate budgeting and eliminates the anxiety of unexpected bills or cost overruns. It also incentivizes attorney efficiency, as they are working within a fixed budget. Furthermore, the billing and payment process is simplified, saving you time and administrative headaches. For musicians, producers, and artists, this predictable pricing model can be invaluable when navigating contracts, intellectual property rights, and other legal aspects of their creative endeavors.

However, it's important to be aware of the potential downsides. A flat fee may not cover unexpected scope changes or complications that arise during the process. If the scope of work needs to be expanded, you may incur additional fees. For very simple matters, a flat fee could potentially be more expensive than hourly billing. There’s also the risk that an attorney might rush the work to maximize profit, though a reputable attorney will always prioritize quality. Finally, comparing the value offered by different providers can be challenging with flat fees, as the scope of services included might vary.

To ensure a smooth experience with a flat fee arrangement, consider these tips: Clearly define the scope boundaries in writing, leaving no room for ambiguity. Understand what revisions are included in the quoted price. Ask about potential additional fees for scope changes. Compare flat fees and scopes of work across multiple attorneys before making a decision. These steps can help you secure the best possible legal representation for your small business at a predictable and manageable cost. Choosing a flat fee arrangement can be a smart move for attorney fees for small business, allowing you to focus on growing your enterprise without the uncertainty of fluctuating legal expenses. This transparent and predictable pricing model empowers you to make informed decisions, ensuring your legal needs are met efficiently and effectively.

3. Retainer Fees

Retainer fees are a common practice in the legal world, and they play a significant role in how attorney fees for small businesses are structured. Essentially, a retainer fee is an upfront payment that secures an attorney's services and covers future legal work. Think of it as pre-paying for your legal needs. This arrangement provides several benefits for both the attorney and the client, making it a valuable option for small businesses looking to establish a consistent and reliable legal resource.

There are two primary types of retainer fees: advance payment retainers and non-refundable retainers. An advance payment retainer works like a pre-paid account. The money is held in the attorney’s trust account, and as the attorney performs legal work for you, their fees are deducted from this balance. You’ll receive regular invoices detailing the work performed and the remaining retainer balance. When the retainer runs low, you'll be asked to replenish it. A non-refundable retainer, on the other hand, compensates the attorney primarily for their availability and the initial work involved in understanding your business and legal needs. This type is less common for ongoing general counsel but might be used for specific projects.

For small business owners, especially those in dynamic fields like entertainment, music production, or intellectual property innovation, having readily accessible legal counsel is crucial. A retainer arrangement provides that crucial access. Whether you’re a rapper navigating complex music contracts, a music artist manager protecting your artists' rights, a singer needing advice on publishing deals, an entrepreneur with a unique business idea, or an established business owner dealing with ongoing legal matters, a retainer can offer the proactive legal support you need.

Features of Retainer Agreements:

- Upfront payment held in trust account: Your retainer is held securely and used solely for your legal expenses.

- Hourly work billed against retainer balance: You receive clear and regular accounting of how your retainer funds are being utilized.

- Requires replenishment when balance runs low: Maintaining the retainer ensures continuous access to your attorney's services.

- Creates ongoing attorney-client relationship: This fosters a deeper understanding of your business and legal needs, leading to more effective representation.

Pros of Using a Retainer:

- Secures attorney availability and priority: You gain privileged access to your attorney's expertise and time, ensuring your legal needs are addressed promptly.

- Spreads legal costs over time: Budgeting for legal expenses becomes more predictable and manageable, avoiding unexpected large bills.

- Often results in better rates: Attorneys may offer discounted hourly rates for clients on retainer.

- Builds stronger attorney-client relationship: Consistent interaction creates a foundation of trust and understanding, leading to more effective legal strategies.

Cons of Using a Retainer:

- Large upfront payment required: This can be a significant financial commitment for some small businesses.

- Unused portions may be difficult to recover (with non-refundable retainers): It's essential to understand the terms of your retainer agreement, particularly regarding refunds.

- Requires ongoing monitoring of balance: Staying informed about your retainer balance is key to avoiding service interruptions.

- May encourage unnecessary legal work (in some cases): Choose an attorney you trust to provide only necessary legal advice.

Examples of Retainer Fees for Small Businesses:

- General business counsel: $5,000-$15,000 annual retainer

- Contract review services: $2,500-$7,500 quarterly retainer

- Employment law matters: $3,000-$10,000 retainer

- Intellectual property work: $5,000-$20,000 retainer

Tips for Navigating Retainer Agreements:

- Negotiate refundable vs. non-refundable terms: Clearly define what happens to unused funds.

- Request monthly billing statements: Stay informed about your retainer balance and the legal work performed.

- Establish clear replenishment procedures: Understand how and when you need to replenish your retainer.

- Understand termination and refund policies: Know the process for ending the retainer agreement and any potential refunds.

Learn more about Retainer Fees

Deciding whether or not to use a retainer agreement is a crucial decision for any small business. By understanding how retainer fees work, weighing the pros and cons, and following the tips outlined above, you can make an informed decision that best suits your specific needs and budget. Having reliable and readily available legal counsel is a significant advantage in today’s complex business environment, and a retainer agreement can be an effective way to achieve that.

4. Contingency Fees: No Win, No Fee Legal Representation for Your Small Business

When facing legal challenges, attorney fees can be a significant concern for small business owners, especially those operating on tight budgets. Contingency fees offer an alternative fee arrangement that can make legal representation more accessible. This “no win, no fee” structure means attorneys only receive payment if they achieve a successful outcome in your case, taking a percentage of any monetary recovery as their fee. While less common in some areas of small business law, contingency fee arrangements are frequently used in certain commercial litigation, debt collection, and business dispute cases. This approach can be a lifeline for cash-strapped businesses seeking legal recourse.

How Contingency Fees Work

Under a contingency fee agreement, you won't be required to pay any upfront legal fees or retainers. Instead, your attorney will take a pre-agreed percentage of the money recovered on your behalf, whether through a settlement or a court judgment. This percentage typically ranges from 25% to 40%, depending on the complexity of the case, the attorney's experience, and the potential for recovery. It’s crucial to remember, however, that while you won’t owe attorney fees if the case is unsuccessful, you will typically remain responsible for out-of-pocket case expenses such as court filing fees, expert witness fees, and other costs associated with pursuing the case.

When Contingency Fees Make Sense for Your Business

Contingency fees are particularly attractive for small businesses facing legal battles where:

- Funds are limited: If upfront legal costs are prohibitive, a contingency arrangement allows you to pursue a valid claim without depleting your operating capital. This is especially beneficial for startups and small businesses facing financial constraints.

- The case involves monetary recovery: Contingency fees are best suited for cases where the goal is to recover a specific sum of money, such as in breach of contract disputes, debt collection, or certain types of commercial litigation. They are less applicable in cases where the primary objective is something other than financial compensation, such as obtaining an injunction.

- You have a strong case: Attorneys are more likely to take cases on a contingency basis when they believe there’s a high probability of success and a significant potential recovery. This incentivizes them to work diligently to achieve the best possible outcome for you.

Examples of Contingency Fee Arrangements in Small Business Cases:

- Business debt collection: Recovering outstanding payments from clients or customers can be challenging. A contingency fee arrangement with an attorney can help you pursue these debts aggressively, with the attorney typically receiving 25-35% of the amounts recovered.

- Commercial litigation: If your business is involved in a contract dispute or other commercial litigation where financial damages are sought, a contingency fee arrangement can be a viable option. Attorney fees in these cases typically range from 30-40% of the damages awarded.

- Insurance claim disputes: If an insurance company wrongfully denies or undervalues a claim, a contingency fee lawyer can help you fight for the full compensation you deserve, often taking 25-33% of the eventual settlement.

- Partnership dissolution disputes: If a business partnership dissolves and disputes arise over the division of assets, a contingency fee lawyer can represent your interests and typically receive 30-40% of the assets recovered for you.

Tips for Navigating Contingency Fee Agreements:

- Clearly define “success” and “recovery”: Your agreement should clearly outline what constitutes a successful outcome and what portion of any recovery is subject to the contingency fee.

- Negotiate the percentage: Don't be afraid to negotiate the percentage rate, especially if your case is straightforward or the potential recovery is substantial.

- Clarify responsibility for expenses: Ensure the agreement clearly specifies who is responsible for covering case expenses, regardless of the outcome.

- Get everything in writing: A written contingency fee agreement is crucial. It should clearly outline all terms and conditions, including the fee percentage, the definition of success, and the responsibility for expenses.

Contingency fee arrangements offer a valuable pathway to justice for small businesses facing legal challenges with limited resources. By understanding how these arrangements work and following these tips, you can make informed decisions about whether a contingency fee arrangement is the right choice for your business. This approach allows entrepreneurs, established business owners, artists, innovators, and anyone with a unique idea – from rappers and music producers to singers and their managers – to access quality legal representation and protect their interests without the burden of upfront attorney fees for small business legal issues.

5. Monthly Subscription/Membership Fees

For small businesses seeking predictable and accessible legal counsel, monthly subscription or membership fees offer a compelling alternative to traditional hourly billing. This model provides ongoing legal support, access to document templates, and consultation services for a fixed monthly fee. Think of it like a gym membership for your business's legal needs—you pay a regular fee for access to a suite of services designed to keep you legally fit. This approach democratizes legal access by offering predictable costs and, often, unlimited consultations within defined parameters. This makes seeking legal advice less daunting and more proactive, particularly beneficial for budget-conscious entrepreneurs.

This fee structure is especially well-suited for small businesses, startups, creatives, and entrepreneurs in industries like music, entertainment, and intellectual property. For example, imagine you’re a music producer working on a new album. You might need advice on copyrighting your music, negotiating contracts with artists, or understanding licensing agreements. A monthly legal subscription can provide readily available support for these recurring needs. Similarly, for an independent artist or a rapper navigating the complexities of the music industry, having access to legal counsel on retainer can be invaluable. It allows for quick consultations on matters like trademarking a stage name, reviewing performance contracts, or understanding royalty structures. Even for established businesses, this model offers a streamlined and predictable way to handle everyday legal matters.

Services typically included in these subscriptions encompass a range of preventative and advisory legal support. This might include contract review, legal document templates (NDAs, employment agreements, etc.), business formation advice, and unlimited consultations within the scope of the subscription. Companies like LegalZoom and Rocket Lawyer have popularized this model, offering online legal subscriptions at various price points. Many local law firms also offer tailored subscription packages for small businesses, sometimes focusing on specific industry needs. You can learn more about Monthly Subscription/Membership Fees and how they might fit your specific business needs.

The benefits of this approach are numerous. Predictable monthly budgeting is a key advantage, allowing businesses to forecast their legal expenses accurately. Unlimited consultations (within the defined scope) encourage early legal input, preventing small issues from escalating into costly legal battles. This proactive approach can be particularly beneficial for small business entrepreneurs, entertainers, and artists who may be navigating complex legal landscapes for the first time. Furthermore, the lower barrier to entry for legal services makes it easier for startups and smaller businesses to access legal support, contributing to their overall stability and growth potential. Finally, the model is scalable; as your business grows, you can adjust your subscription level to match your evolving needs.

However, monthly subscriptions aren’t a one-size-fits-all solution. They may not cover complex legal work like litigation or specialized intellectual property disputes. While ideal for preventative measures and general legal guidance, more intricate matters may require additional fees or a shift to traditional hourly billing. There's also the ongoing cost even during inactive periods. If your business experiences a lull and requires minimal legal assistance, you’ll still be paying the monthly fee. The limited scope of some subscriptions may also necessitate additional fees for services outside the pre-defined parameters. Finally, you might experience a less personal relationship with an attorney compared to traditional representation, although many subscription services strive to offer dedicated legal professionals as points of contact.

When considering a legal subscription service, carefully review what services are included and clearly understand the limitations and potential additional fee triggers. Compare subscription-based fees with traditional fee structures to determine the most cost-effective approach for your anticipated legal service usage. Consider your specific industry and legal needs. For instance, if you are an intellectual property innovator, ensure the subscription covers the type of IP advice you require. Finally, if you are a music artist, a music producer, or a music artist manager, check if the service offers expertise in entertainment law. By carefully evaluating your options and choosing a plan aligned with your specific circumstances, you can leverage the advantages of monthly subscription fees to access consistent and affordable legal support, ensuring the long-term health of your business.

Examples of such services include:

- LegalZoom Business Advisory: $99-$299/month

- Rocket Lawyer Business: $99-$199/month

- Local law firm subscriptions: $200-$500/month (prices can vary significantly)

6. Court Costs and Filing Fees: The Unavoidable Expenses of Legal Proceedings

When budgeting for legal representation, it's easy to focus solely on attorney fees for small business. However, a significant portion of your legal expenses will come from court costs and filing fees. These are mandatory charges imposed by courts and government agencies for processing legal matters, and they're distinct from the fees you pay your lawyer. Understanding these costs is crucial for accurate budgeting and informed decision-making when navigating the legal landscape.

Court costs and filing fees cover a range of administrative tasks necessary for your case to proceed. This includes filing documents, serving papers to the opposing party, obtaining official court records, and other administrative processes. These expenses are non-negotiable and are required regardless of whether you win or lose your case. They represent the cost of accessing the legal system and ensuring its smooth operation.

These fees vary significantly based on jurisdiction (whether you're dealing with a federal, state, or local court) and the type of legal action you're involved in. A simple breach of contract case in state court will likely have lower filing fees than a complex intellectual property lawsuit filed in federal court.

Why These Costs Matter for Your Small Business

For small business owners, entertainers, artists, musicians, and innovators, understanding these costs is especially critical. Whether you're registering a trademark, incorporating your business, pursuing a copyright infringement claim, or dealing with a contract dispute, these costs are unavoidable. Ignoring them can lead to budget overruns and unpleasant financial surprises. For example, a rapper seeking to register a trademark for their brand name needs to factor in the trademark registration fee, which can range from $225 to $400 per class of goods/services, in addition to their attorney fees for small business. Similarly, a music artist manager negotiating contracts for their artists needs to be aware of potential court costs associated with any future disputes that might arise.

Features of Court Costs and Filing Fees:

- Set by Court Rules and Government Agencies: These fees are not determined by attorneys; they are established by the governing bodies of the court system and relevant agencies.

- Non-Negotiable: These are mandatory expenses required for access to the legal system.

- Vary by Jurisdiction and Case Type: Fees differ based on where the legal action is filed and the complexity of the case.

- Separate from Attorney Fees: Court costs are distinct from the fees you pay your lawyer for their professional services.

Pros:

- Predictable and Published Fee Schedules: Most courts and agencies publish their fee schedules online, allowing for upfront cost estimation.

- Necessary for Legal System Access: These fees ensure the functioning of the courts and access to justice.

- Same Cost Regardless of Attorney: These costs are standardized and don't change based on your choice of legal representation.

- Often Tax-Deductible Business Expenses: Many court costs and filing fees qualify as tax-deductible business expenses, providing some financial relief.

Cons:

- Additional Cost Beyond Attorney Fees: These costs represent an added expense on top of your legal representation fees.

- Can Be Substantial for Complex Cases: For lengthy or complex legal battles, these fees can accumulate significantly.

- No Guarantee of Favorable Outcome: Paying court costs doesn't guarantee you'll win your case.

- May Be Non-Refundable: Even if your case is dismissed or unsuccessful, some fees may be non-refundable.

Examples of Typical Court Costs and Filing Fees:

- Business license applications: $50-$500

- Federal court filing fees: $350-$500

- State court filing fees: $100-$300

- Trademark registration: $225-$400 per class

- Corporate annual reports: $25-$150

Actionable Tips for Managing Court Costs:

- Budget for these costs in addition to attorney fees: Factor in court costs and filing fees when creating your legal budget.

- Ask attorneys to estimate total court costs upfront: Obtain a clear estimate of anticipated court costs from your lawyer before proceeding.

- Understand which costs are refundable: Inquire about potential refunds for specific fees if your case is resolved early or dismissed.

- Consider whether representation justifies the total cost: Evaluate the overall cost, including attorney fees and court costs, to determine if pursuing legal action is financially viable.

By understanding and proactively managing court costs and filing fees, you can avoid financial surprises and make informed decisions about your legal strategy. This is crucial for anyone engaging with the legal system, from small business entrepreneurs to established business owners, entertainers, and innovators. Being prepared for these expenses will help you navigate the legal process with greater confidence and financial control.

Attorney Fee Types Comparison

| Fee Type | 🔄 Implementation Complexity | 💡 Resource Requirements | 📊 Expected Outcomes | ⭐ Key Advantages | ⚡ Ideal Use Cases |

|---|---|---|---|---|---|

| Hourly Rates | Moderate to High – requires detailed time tracking and billing | Attorney time tracked in short increments, admin overhead for billing | Directly correlates cost with time spent, flexible for varying scope | Transparent billing, pay only for actual work | Complex or unpredictable legal matters |

| Flat Fee Arrangements | Low to Moderate – fixed scope needed and clearly defined | Defined scope limits time/resources | Predictable, fixed cost | Budget certainty, incentivizes efficiency | Routine and predictable legal services |

| Retainer Fees | Moderate – upfront payment and ongoing balance management | Upfront capital, ongoing tracking | Secures attorney availability, smooth cash flow | Priority access, cost spread over time | Ongoing legal support and advisory |

| Contingency Fees | Low to Moderate – outcome-dependent, requires clear agreement | No upfront payment, resources invested by attorney | Payment only if successful, percentage-based | Risk sharing, no upfront cost | Litigation, debt collection, dispute resolution |

| Monthly Subscription/Membership Fees | Low – defined recurring services, tech-enabled delivery | Ongoing monthly fee, access to consultation and templates | Predictable monthly expense, unlimited consults | Affordable access, scalable legal support | Small businesses needing ongoing legal advice |

| Court Costs and Filing Fees | Low – fixed, non-negotiable statutory fees | External government or court fees | Needed for legal process access | Predictable, unavoidable expenses | All legal proceedings requiring filings |

Making Informed Decisions About Your Legal Counsel

Understanding attorney fees for small business is crucial for making sound financial decisions. This article explored six common fee structures: hourly rates, flat fees, retainer fees, contingency fees, monthly subscriptions, and court costs/filing fees. Mastering these concepts empowers you to budget effectively, avoid unexpected expenses, and secure the best legal representation for your unique needs, whether you're an entrepreneur, established business owner, artist, innovator, musician, or music producer. Knowing how attorney fees for small business are structured allows you to confidently pursue your goals, knowing you have the right legal support in place.

By carefully considering these fee arrangements and asking the right questions, you’ll be well-positioned to find an attorney who not only understands your business but also fits within your budget. This knowledge is invaluable, allowing you to focus on what you do best – running and growing your business.

Ready to take control of your legal strategy and ensure your small business is protected? Cordero Law, specializing in attorney fees for small business and representing creatives and entrepreneurs in New York City, offers various fee arrangements tailored to your needs. Visit Cordero Law today to discuss your legal matters and discover how we can help your business thrive.