Why Specialized M&A Legal Counsel Makes All the Difference

Engaging a merger and acquisition (M&A) lawyer is much more than just paperwork. These specialized attorneys serve as strategic advisors, guiding you through each phase of a transaction to ensure its success. This proactive approach differs significantly from using a general business attorney, who may lack the specific M&A expertise.

Strategic Foresight in M&A

An M&A lawyer brings strategic foresight, not just legal knowledge. They can anticipate potential regulatory hurdles and address them proactively, minimizing delays and costly surprises. They can also identify hidden value opportunities and risks that a general business attorney might miss. This proactive approach can significantly impact your transaction's success. For more information on business legal advice, check out this helpful resource: How to master business legal advice.

Uncovering Hidden Value and Mitigating Risk

M&A transactions often involve complex financial structures and negotiations. A skilled M&A lawyer can help structure deals to maximize value for their clients while minimizing risks. They ensure agreements hold up after closing, protecting your interests long-term. This specialized expertise is invaluable in safeguarding your investment.

In 2024, global M&A activity remained resilient despite economic and geopolitical uncertainties. Over 1,000 transactions generated approximately USD 158 billion in disclosed deal value, according to DLA Piper's Global M&A Intelligence Report 2025. However, deal processes took longer due to extended regulatory approvals, highlighting the importance of specialized legal counsel.

The Trusted Advisor in M&A

A key difference an M&A lawyer makes is their role as a trusted advisor. They understand the intricacies of M&A law and provide expert guidance throughout the process. Sometimes, deals fall through, or partnerships need to end. For guidance on dissolving a business partnership, this resource might be helpful: How to dissolve a business partnership. This support is crucial during the stressful period of an M&A transaction.

Practical Examples and Real-World Impact

Many transactions have been saved by the timely intervention of experienced M&A lawyers. These professionals bring a wealth of experience in navigating complex deals and resolving critical issues. Their expertise can be the difference between success and failure, especially when significant sums are at stake. They are deal champions, protecting your interests and ensuring the best possible outcome.

Perfect Timing: When to Bring in Your M&A Legal Team

Timing is crucial in mergers and acquisitions. Engaging an M&A lawyer at the right time can significantly impact a successful transaction. Early involvement allows them to shape the deal structure, improve your negotiating position, and protect your interests.

Early Legal Counsel: A Strategic Advantage

Bringing in legal counsel early is a strategic decision. An M&A lawyer can analyze potential deal structures early on, identifying the most advantageous path. They can also prepare for negotiations, ensuring you enter discussions with a clear understanding of your legal rights and obligations. This proactive approach facilitates a smoother, more efficient transaction.

Recognizing When General Counsel Isn't Enough

While your general counsel handles daily legal matters, M&A transactions often demand specialized expertise. Warning signs that you need dedicated M&A counsel include complex deal structures, cross-border transactions, or significant regulatory hurdles. For example, if your deal involves multiple jurisdictions or complex financing, a specialized lawyer's experience is invaluable.

Regulatory Roadblocks and Legal Leverage

Forward-thinking dealmakers engage M&A lawyers to identify and address potential regulatory roadblocks early on. These legal experts understand the complexities of antitrust laws, securities regulations, and other legal frameworks governing M&A activity. Their proactive approach helps anticipate potential issues and develop strategies to overcome them, strengthening your negotiating position.

Global M&A activity highlights the increasing complexity of transactions. While the total volume of deals decreased by 13% recently, the total deal value increased by 9%. This indicates a trend toward larger, more complex transactions. Discover more insights about global M&A trends This reinforces the importance of specialized legal counsel who can navigate these large-scale deals.

Budgeting for Legal Expertise

Cost is a valid concern, but legal fees should be viewed as an investment. A skilled M&A lawyer can help avoid costly mistakes and maximize the transaction's value. Their services can be structured cost-effectively, tailored to your needs and budget.

Tailoring Legal Strategies to Deal Phases

Different deal phases require different legal strategies. Initial stages focus on due diligence and deal structuring. As the deal progresses, negotiations and regulatory approvals take center stage. Finally, post-closing integration requires careful legal oversight. A skilled M&A lawyer adapts their approach to each phase, ensuring a seamless and successful transaction.

The M&A Lawyer's Toolbox: Services That Drive Deal Success

Exceptional merger and acquisition (M&A) lawyers offer more than just legal paperwork. They provide a comprehensive suite of services spanning the entire transaction lifecycle, from initial planning to post-closing integration. This thorough approach ensures deal success and protects your interests.

Due Diligence: Uncovering Hidden Opportunities

Due diligence is a crucial step in any M&A transaction. A skilled M&A lawyer transforms this process from a simple checklist into strategic intelligence gathering. They analyze the target company's financials, legal compliance, and operations to identify potential risks and uncover hidden opportunities.

This proactive approach informs negotiation strategy and helps maximize deal value. By identifying potential liabilities early on, M&A lawyers help minimize future problems and ensure a smoother transaction process.

Structuring the Deal: A Delicate Balancing Act

Deal structure is a critical element in M&A. Experienced M&A lawyers craft structures that protect your interests while addressing the counterparty's concerns. This balancing act requires a deep understanding of both legal and business principles.

For example, structuring a deal as an asset purchase instead of a stock purchase can limit liability. Learn more about the intricacies of asset and stock purchases: How to master asset and stock purchases. A well-structured deal sets the foundation for a successful transaction and long-term stability.

Coordinating the Deal Team: Ensuring a Cohesive Approach

M&A transactions involve a diverse team of advisors, including financial advisors, accountants, and other specialists. The M&A lawyer plays a central role in coordinating this team and ensuring a cohesive approach.

They facilitate communication, manage timelines, and resolve conflicts, ensuring everyone works towards a shared goal. This coordinated effort anticipates and addresses potential challenges before they escalate into major obstacles.

Tailored Legal Strategies for Different Transaction Types

Every M&A transaction is unique. Strategic acquisitions, divestitures, mergers, and family business transitions each present specific legal considerations. Experienced M&A lawyers tailor their approach to each transaction type, providing custom solutions.

For example, a family business transition requires careful consideration of succession planning and estate tax implications. A strategic acquisition may focus on antitrust concerns and market dominance. This specialized approach maximizes value and minimizes risk in each situation.

The following table outlines the core services provided by M&A legal counsel across various transaction phases. It highlights the strategic value they bring to each stage of the deal.

Core Services of M&A Legal Counsel

This table outlines the essential services provided by merger and acquisition lawyers across different transaction phases

| Transaction Phase | Key Legal Services | Strategic Value Added |

|---|---|---|

| Due Diligence | Document review, financial analysis, legal compliance assessment | Identifies risks and opportunities, informs negotiation strategy |

| Deal Structuring | Negotiation and drafting of transaction agreements | Protects client interests, optimizes deal terms, minimizes liability |

| Deal Execution | Coordination of closing activities, regulatory filings | Ensures a smooth and efficient closing process |

| Post-Closing Integration | Legal support during integration of operations, contracts, and personnel | Facilitates a seamless transition and helps realize the deal's full potential |

This table demonstrates the breadth of services provided by M&A lawyers and the vital role they play in achieving deal success. Their expertise helps clients navigate complex legal processes and maximize the value of their transactions.

Post-Closing Integration: Supporting a Smooth Transition

The transaction doesn't end at closing. Post-closing integration is crucial, as merging entities combine operations and cultures. M&A lawyers provide essential support during this phase, addressing legal issues that arise during integration.

They oversee the implementation of deal terms, ensuring compliance and addressing any unexpected legal matters. This ongoing support ensures a smooth transition and helps realize the deal's benefits. This attention to detail highlights the comprehensive nature of M&A legal services, extending far beyond the closing date.

Finding Your Deal Champion: Selecting the Right M&A Lawyer

Choosing the right Mergers and Acquisitions (M&A) lawyer can significantly impact your transaction's success. It's not simply about legal expertise; it's about securing a strategic advisor who understands your business objectives. Experienced dealmakers emphasize that selecting effective M&A counsel involves more than just verifying credentials.

Beyond the Basics: Key Selection Criteria

Basic credentials are essential, but you should also seek a lawyer with relevant industry experience and experience handling deals of similar size. For example, a lawyer specializing in technology transactions will grasp the specific nuances of that sector. Furthermore, ensure a good cultural fit between the lawyer and your organization. This alignment promotes clear communication and a productive working relationship.

Asking the Right Questions

Savvy clients delve deeper than surface-level credentials. They ask insightful questions to assess a lawyer's negotiation tactics and problem-solving abilities. Inquiries about their experience with comparable deals reveal practical knowledge. Questions about their approach to challenging negotiations offer insights into their strategic thinking. These conversations highlight how the lawyer performs under pressure and their commitment to protecting your interests.

Fee Structures: Finding the Right Fit

Understanding fee structures is crucial. Options include hourly rates and success-based arrangements. Hourly rates provide predictability but can lead to higher overall costs. Success-based fees align incentives but may not suit every transaction. Carefully consider which model best aligns with your deal type and budget. This financial clarity is essential for managing transaction expenses.

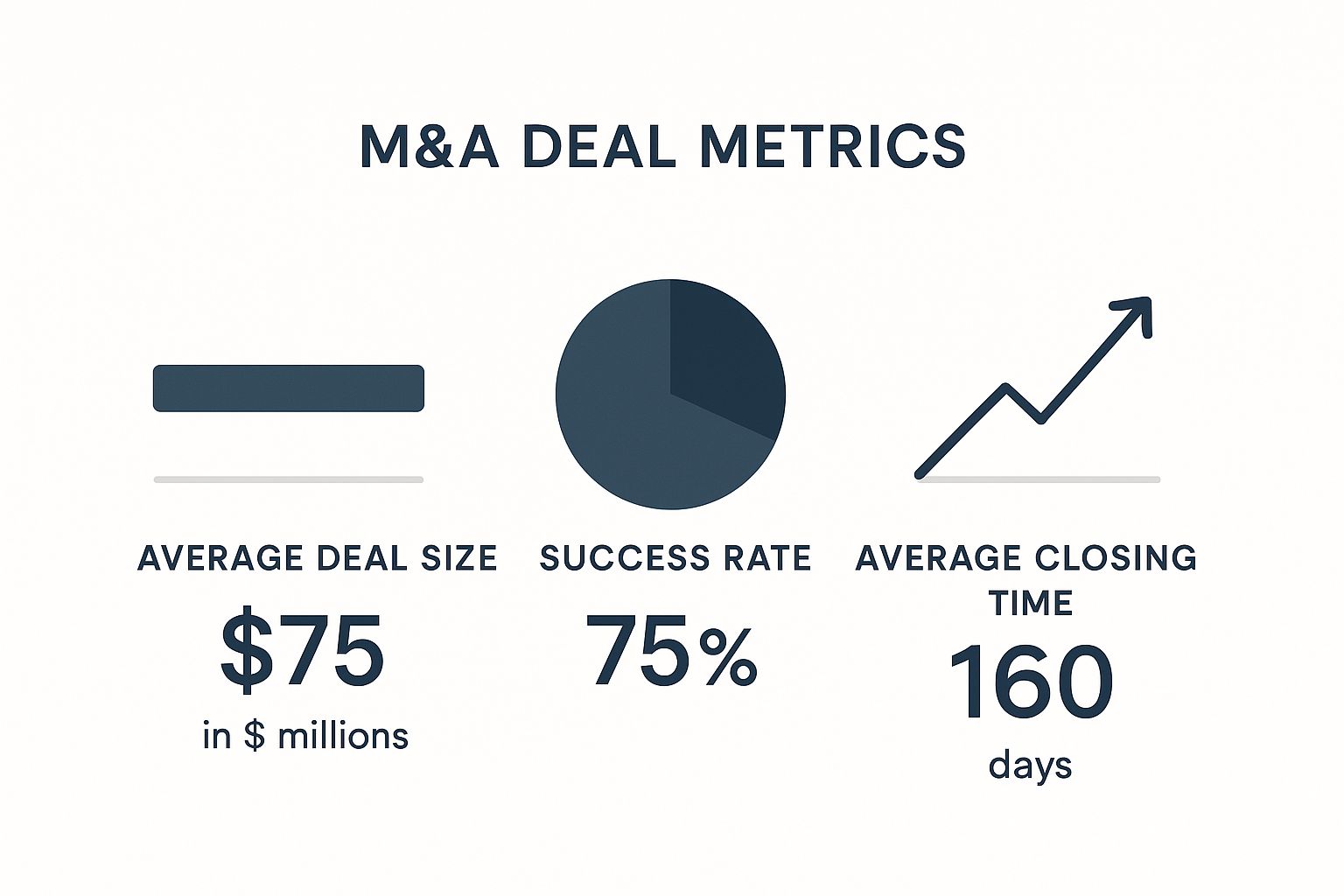

The infographic below illustrates key M&A deal metrics: Average Deal Size (in $ millions), Success Rate (%) of completed deals, and Average Closing Time (in days).

This visualization emphasizes the importance of deal size, success rate, and closing time in M&A transactions, all of which are significantly influenced by the chosen legal counsel. These metrics highlight the need for a lawyer who can not only close deals but also do so efficiently and effectively.

To help you compare different legal counsel options, consider the following table:

M&A Lawyer Selection Criteria Comparison

This comparison table helps evaluate potential legal counsel based on key selection factors for different transaction types.

| Selection Criteria | Small/Mid-Market Deals | Large Complex Transactions | Cross-Border Deals |

|---|---|---|---|

| Industry Expertise | Important, but niche expertise may be less critical | Essential, especially in regulated industries | Crucial, including international legal frameworks |

| Deal Size Experience | Look for experience with similar transaction values | Extensive experience with large-scale deals is a must | Experience navigating complex cross-border regulations is key |

| Negotiation Style | Collaborative and pragmatic | Strategic and assertive, with expertise in complex negotiations | Culturally sensitive and adept at international deal-making |

| Fee Structure | Hourly rates or blended arrangements | Primarily hourly rates, potentially with success fees for specific milestones | Hourly rates or capped fees, depending on the scope of work |

| International Network (if applicable) | Less critical | Beneficial for cross-border elements | Essential, with strong connections in relevant jurisdictions |

This table summarizes key selection criteria for M&A lawyers based on the type of deal. For smaller deals, industry expertise is important, while for larger and cross-border deals it becomes absolutely crucial. The complexity of the deal also influences the necessary negotiation style and fee structure considerations.

Boutique vs. Global: Choosing the Right Firm Size

Choosing between a boutique firm and a global practice depends on your needs. Boutique firms provide personalized attention and deep industry knowledge. Global practices offer extensive resources and international reach. For instance, a technology startup might benefit from a boutique firm specializing in tech M&A. A multinational corporation expanding into new markets, however, would likely require the resources of a global firm like Goodwin.

Legal services are increasingly vital for successful deal execution. The demand for expert legal advice in complex sectors continues to grow. You can read more about the growing importance of legal services in M&A here. Choosing the right M&A lawyer is a strategic decision with long-term implications. It's about finding a deal champion who will guide you towards a successful outcome.

Creating a Deal-Winning Partnership With Your Legal Team

A successful merger or acquisition depends heavily on effective teamwork between the involved parties and their merger and acquisition lawyer. This collaborative relationship should go beyond basic legal advice, turning your legal team into key strategic partners. This section explores how to build such a partnership for the best possible deal outcomes.

Open Communication: The Foundation of Success

Clear communication is the cornerstone of any successful attorney-client relationship. Establish regular channels for communication to ensure information flows smoothly between your team and your legal counsel.

This could include weekly meetings, regular progress reports, or using dedicated communication platforms like Slack. Consistent information sharing keeps everyone in the loop and working toward the same goals.

Setting Expectations: A Two-Way Street

Realistic expectations should be set from the very beginning. Clearly outline your goals and objectives for the transaction. At the same time, allow your lawyer to explain potential legal hurdles and realistic timelines.

This mutual understanding helps avoid misunderstandings and creates a more productive working relationship. Understanding the typical timeframe for regulatory approvals, for example, helps manage expectations and prevents unnecessary frustration.

Preparing for Legal Meetings: Maximizing Value and Minimizing Costs

Preparation is crucial to getting the most out of legal meetings. Provide your lawyer with all the necessary documents and information in advance. This allows them to focus on providing strategic advice instead of spending time gathering facts during the meeting.

This proactive approach minimizes billable hours and ensures efficient use of everyone's time. Also, prepare a list of questions or concerns to discuss during the meeting to ensure all important issues are addressed.

Leveraging Legal Expertise for Negotiation Advantage

Experienced dealmakers know the importance of their merger and acquisition lawyer's expertise during negotiations. Your legal team can identify potential risks and opportunities, anticipate the other side's tactics, and structure deals to protect your interests.

This strategic use of legal counsel can give you a significant edge in negotiations. It means you can proactively shape the deal's terms instead of merely reacting to proposals.

Balancing Business Priorities and Legal Judgement

While your lawyer offers legal guidance, the final business decisions rest with you. It's important to learn when to rely on legal judgment and when to assert your business priorities.

Openly discuss the potential risks and rewards with your lawyer to arrive at informed decisions that balance legal considerations with your commercial objectives. For instance, while your lawyer may advise against a specific clause, you might choose to accept it if the overall deal benefits outweigh the potential downsides.

From Service Provider to Strategic Partner

Elevate your legal team from technical service providers to true strategic partners invested in your transaction's success. By encouraging open communication, establishing clear expectations, and actively involving your lawyer in strategic decisions, you create a powerful partnership that can greatly influence your transaction’s outcome.

This collaborative approach ensures your legal team isn't just reacting to developments but proactively striving to achieve your deal objectives.

Avoiding Deal-Killers: Legal Pitfalls the Pros Watch For

Even seasoned dealmakers can stumble upon legal traps that threaten transactions or create significant post-closing liabilities. Understanding these pitfalls is crucial for a smooth and successful merger and acquisition (M&A). This section explores common legal risks in M&A and suggests strategies to mitigate them.

Due Diligence Failures: Uncovering Hidden Risks

Thorough due diligence is paramount in M&A. Insufficient due diligence can expose acquirers to unforeseen liabilities. These might include undisclosed environmental contamination, intellectual property disputes, or inaccurate financial records.

For example, neglecting a thorough review of a target company's contracts could reveal unexpected obligations or lost revenue streams. This highlights the importance of meticulous due diligence in protecting the acquirer's interests.

Regulatory Roadblocks: Navigating Complex Legal Frameworks

Regulatory hurdles can significantly delay or even derail M&A transactions. Antitrust regulations, securities laws, and industry-specific regulations can create complex compliance requirements.

For instance, a merger between two large companies in the same industry might raise antitrust concerns, requiring extensive review and potentially restructuring the deal. Careful consideration of these regulatory landscapes is vital.

Intellectual Property Complications: Protecting Valuable Assets

Intellectual property (IP) is often a key asset in M&A. However, unclear ownership, inadequate protection, or ongoing IP litigation can create significant challenges.

Imagine acquiring a software company only to discover its core technology is entangled in a patent infringement lawsuit. This could devalue the acquisition or lead to expensive legal battles, emphasizing the importance of thorough IP due diligence.

Employment Issues: Managing Workforce Transitions

Mergers and acquisitions frequently involve workforce changes. These changes can generate legal complexities related to employee benefits, severance agreements, and non-compete clauses.

For example, failing to properly address employee benefits during a merger can result in legal disputes and financial penalties. Navigating these employment-related issues requires careful legal planning and consideration. You might be interested in: How to master legal help for small business.

Industry-Specific Challenges: Tailoring Legal Strategies

Different industries face unique legal challenges in M&A. Healthcare transactions, for example, must comply with HIPAA and other healthcare regulations. Technology deals often involve complex IP and data privacy issues. Manufacturing acquisitions may require environmental due diligence and compliance with workplace safety regulations. Recognizing these industry-specific challenges is crucial for effective legal planning.

Preventive Measures and Remediation Approaches

Proactive legal planning can help avoid many of these M&A pitfalls. This includes conducting comprehensive due diligence, engaging experienced M&A lawyers early in the process, and developing robust legal agreements that address potential contingencies.

However, even with meticulous planning, problems can arise. Having a remediation plan, such as renegotiating deal terms or seeking legal remedies, is essential. Partnering with your legal team involves showcasing their contributions, much like sharing client achievements; explore some client success story examples.

By understanding these common legal pitfalls and implementing appropriate preventive measures, dealmakers can significantly increase the likelihood of a successful and value-creating transaction.

Ready to navigate your M&A transaction with confidence? Cordero Law provides expert legal guidance through every stage of the process. Visit us today to learn how we can help you achieve your M&A goals.